Rate Based Service Activities (RBSA)

FAQs

RBSAs are defined as activities in which goods or services are provided at consistent rates based on units (e.g., per hour, test, usage, etc.), in any volume or frequency, to customers internal or external to the University of Colorado (CU). The activity must provide a routine service at a fixed rate, available to any internal or external customer, including the general public.

ISAs are RBSAs that mainly serve only internal customers. Any external customers are incidental and are operated by an Internal Sales Center (ISC).

Services provided by RBSAs, as defined in the Federal Uniform Guidance Part 200.468, must comply with the Federal Register Uniform Guidance. Services are those provided by highly complex or specialized facilities which are operated by UCCS.

Exempt activities:

- Instruction for academic credit

- Event/venue tickets, membership fees, subscription dues

- Corporate sponsorships; sale of advertising space

- Fees or fines assessed to students or the public

- Retail-like resale of goods at or near cost

- Contractual revenue sharing with an outside vendor

- Direct reimbursements

- Contracts between the University and another entity where the service rate is specific to that agreement

- Officially designated Auxiliary Enterprises (Fund 20)

- Other exemptions approved by the Controller's Office

Internal customers include those within the university as well as federally sponsored projects. These customers use university speedtypes, except for Fund 80s, or procurement cards for purchasing. Internal customers must all be charged at the same rate and must be non-discriminatory towards federally sponsored projects. The rate charged to internal customers must be calculated based on a break-even methodology, meaning that the rate should be developed to recoup costs for the products or services rendered. External customers may have higher rates than those used for internal costs. External customers include students, Fund 80 speedtypes, and corporate entities.

*Note that external customers may be subject to sales tax.

RBSA and ISA rates are required to calculate the actual cost of providing services at least biennially. Rate calculations must capture all of the expected costs of operating the RBSA or ISA, even if some of the costs will be subsidized by the department itself. The allocation of total recoverable costs should be assigned to projected sales units in a reasonable and consistent manner. RBSAs and ISAs offering more than one product or service should complete a separate rate calculation for each product or service.

- Charges for the services must be charged directly and must be calculated based on an established rate or methodology.

- Rates must be non-discriminatory against federally supported activities of UCCS and internal customers.

- Rates should be reviewed at least every two years, unless given an exception by the Controller's Office, and should be developed with the basis of recovering aggregate costs for the services provided.

- Unallowable costs must be excluded. For additional information on expenses that are unallowable, refer to OMB Uniform Guidance subpart E, subtitle VI for a complete list.

Examples of Unallowable Cost

- Alcoholic Beverages

- Alumni Activities

- Entertainment Costs

- Membership & Subscriptions

- Public Relations & Advertising

The rates are calculated as a cost-based rate. For internal customers, this rate is calculated on a break-even basis meaning that the rate is developed solely to recoup the expense to provide the goods or service, and no profit margin is included. The internal rate is calculated by using the formula below. Departments should use the appropriate rate sheet, under the Forms section, if a rate approval is required.

ISA Rate = Total annual cost for providing the goods or services ((+) Plus prior year under-recover/deficit OR (-) Minus prior year over-recovery/surplus and (-) Minus any departmental subsidy) divided by projected production volume during the year (ex: anticipated total units produced, machine hours, labor hours, etc.).

For internal and federal customers, a 60-day expense reserve can be included in the rate(s). If the RBSA does not have internal customers, the external rate cannot be less than what the internal rate would have been, but it can be as high as the market rate for a similar good or service.

1. Determine if your activity needs an approved rate. Questions to consider when making this determination include the following:

- Are you providing, on an ongoing basis, either a product or service to campus units, federally sponsored projects, or outside entities that does not fall under one of the exemption categories?

- Does a demand exist for this product or service?

- Are you able to develop a rate that will charge internal customers equally for products or services being provided?

- Do you anticipate that products or services will be provided or charged to federal grants? If so, are you able to develop a rate that will charge federal customers equally for products or services being provided?

2. Determine measurable units for products or services you would like to sell. Ex: Labor hours, machine hours, per unit, etc.

3. Complete the rate calculation sheet found in the Forms sections.

4. Send an electronic copy via email to rbsa@uccs.edu.

5. Establish an accounting structure.

- Generally, RBSAs/ISAs are operated from Funds 28 or 29. They must be budgeted and accounted for separately from other unit/department activities.

- RBSAs/ISAs must follow the campus requirements for internal controls for cash, inventory, and accounts receivable.

6. Notify the Budget & Planning Office of the anticipated annual revenue as it will need to be budgeted separately from the unit/department's activities.

RISK LEVELS

Based on the information provided by the University unit or department, the Controller's Office will categorize the RBSA into one of the following risk levels: LOW, MEDIUM, or HIGH.

The risk level determines the level of annual review and oversight required.

RISK TABLE (based on annual internal sales) | ||

| Annual Internal Sales Level | No Federal Participation | Federal Participation |

| $10,000 or less | LOW Rate submission is not required. A one-time certification is required | LOW Rate submission is not required. A one-time certification is required |

$10,001 - $100,000 | MEDIUM Biennial rate determination required | MEDIUM Biennial rate determination required |

$100,001 - $500,000 | MEDIUM Biennial rate determination required | HIGH Annual rate determination required |

Greater than $500,000 | HIGH Annual rate determination required | HIGH Annual rate determination required |

NOTE: All rates require approval from department chair or manager including certifications.

Low risk activities, including those with no internal sales nor federal participation, require a brief, one-time certification and statement of selected rates and will stand until the risk level increases, then a rate determination is required.

The Controller’s Office will review all RBSAs annually for changes that may affect risk levels.

It is the responsibility of the RBSA to inform the Controller’s Office of any changes that may affect risk level.

A rate should be submitted for approval if any of these situations apply:

1) A new activity is determined to be a RBSA.

2) An existing RBSA has:

a) had a change in the customer type.

OR

b) sales volume that increased to over $10,000 annually for internal customers.

3) A rate review is required based on the assigned risk level.

*Rate reviews are due by March 31st annually or biennially according to the risk level assigned by the Controller's Office.

Approved RBSA rates should be adjusted annually to capture the change in the Fringe Benefit Rates. This can be updated without a new rate approval if this is the ONLY change.

Annual/biennial reviews still need to be submitted in accordance with the review cycle for each RBSA as determined by the Controller’s Office.

Products or services should be billed within 30 days. Billing may not occur prior to services being rendered, and as a result, advanced billing cannot be provided. If the service is being provided on an on-going basis, interim billing is highly encouraged but not required.

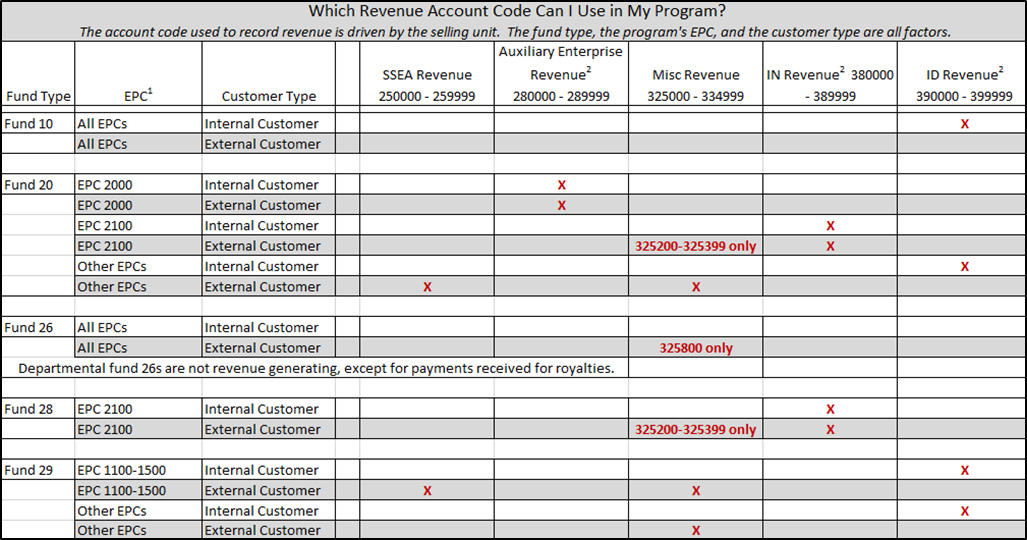

- IN revenue should be recorded in an account within the range of 380100-389999.

- ID revenue should be recorded in an account within the range of 390000-399999.

- Revenue from external sales should be recorded in SSEA, range of 250000-259999 or Miscellaneous Revenue (if in a Fund 28 or 29), range 325000-333500.

If you are unsure what account the revenue should be recorded, contact the Controller's Office for assistance. Also, you can use the following chart as a guide on what revenue account to use:

.

.

Documentation for annual rate calculation as well as records for goods and services sold to customers should be maintained for a minimum of three years plus the current fiscal year.

Fund 30 Exception

If a sale was made to a Fund 30, then the documentation must be retained by the project for 6 years following the termination of grant contract.